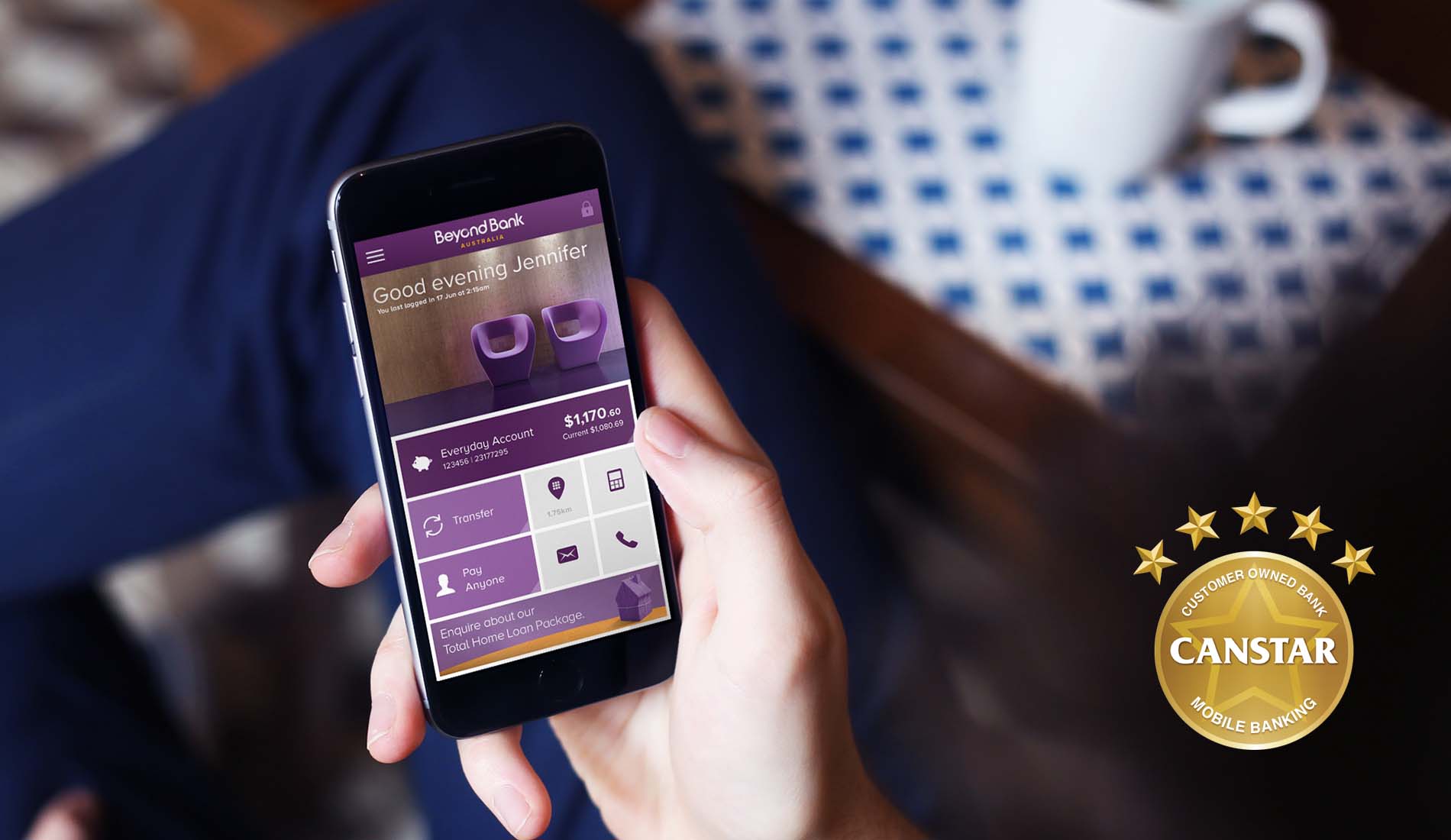

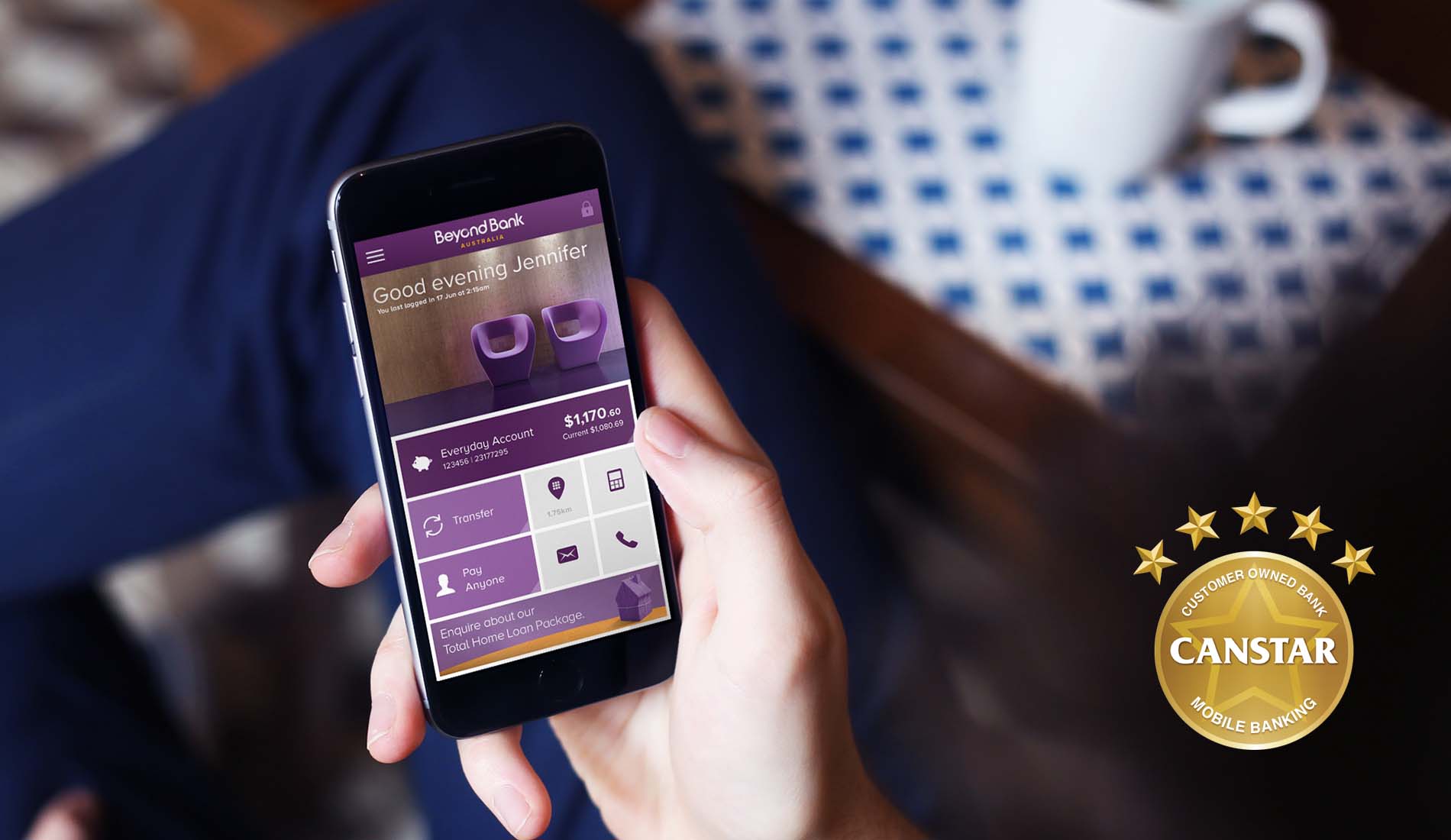

Beyond Bank mobile banking app wins CANSTAR award

We're proud to announce that Beyond Bank has won a prestigious CANSTAR Award for their mobile banking app, which has been created by Fusion.

Ah… apathy. Sorry, we meant lethargy. Oops. One more go. Loyalty. That’s it.

Loyalty. Loyalty. Loyalty. Assuming that you believe such a thing exists, then it’s the holy grail of the established brand.

For financial institutions, customer loyalty remains the cornerstone of revenue. Keep a banking customer for a lifetime and you've got credit as they buy new cars, houses, renovations, holidays, school fees and more.

Loafing loyalists

Dig into banking customer survey data and there is a sense of disquiet, where an Oz-like curtain hides a different state.

For loyalty, read laziness. The majority of banking customers stick with brands, products, loans or rates because they can’t be bothered to change. ‘Get a lower rate and go fee-free? Sounds like a bit of hard work mate, besides, I want to see if the Starks have a good wedding day. The Chief Retention Officer (CRO) sleeps soundly as long as human nature takes the short route to doing nothing. Besides, who likes filling out forms?

But the CRO may soon be having nightmares.

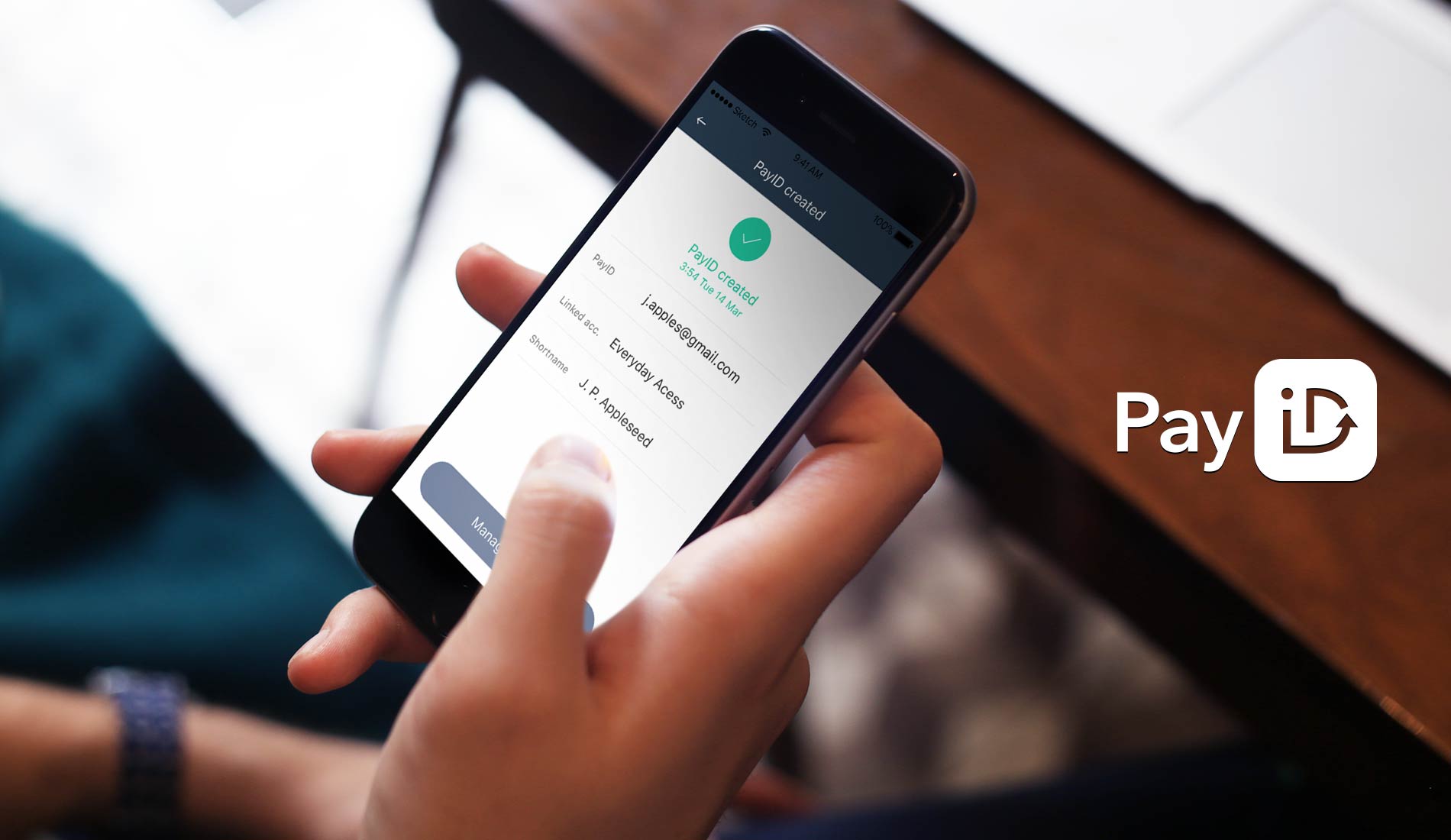

Enter PayID

Until now, a banking customer is identified by an institution-centric means. An archaic, ‘banking is a place you go’ kind of identification.

The BSB stands for Bank, State, Branch number. That’s right, a branch. Bricks, mortar and lunchtime queues. A good place to borrow a pen from.

6 digits locates the physical place you bank at, and then anything from 6 to 10 characters identify your account number. This means that in a bank-to-bank transaction, you are reduced to a randomly assigned number. A number that for the life of you you can't remember when you need to most.

If we asked you right now what your account number is, could you tell us?

PayID flips the decision on how to identify the customer into the hands of the person who has to memorise it: your customer. The ability to pick something memorable, like your mobile phone number or email address, shifts the power from the bank to the customer.

When you use a more personal ID, you embrace a tendency to carry it around with you more readily. Facebook’s ‘log in with FB’ functionality is a brilliant example of this. The simplicity of using a pre-filled, already authenticated-to-me means makes gaining access smooth and effortless. One less new ID to have to remember, and one that was set up with your name and email address from the outset.

ID Deja Vu

We’ve seen porting of a memorable ID before. The ability to take your mobile phone number between telco carriers was introduced in Australia in 2001, and with it came a change in consumer behaviour. Contract aside, there was one less hurdle in the way of exiting a telco brand.

(Back then, we didn’t have rose gold as a choice.. but we did have tropical island!)

Viewed from the other side, it was one less barrier to entry too. Telcos have intensely marketed the ability to switch easily, bringing your number (and phone) to them. Even the idea of ‘your number’ amplifies the personal, memorable quality of this piece of ID.

When you consider the desire to ‘keep our number’, the loyalty shifts from being brand-based to effort-based. Dwell on this thought: how many aspects of your life do you keep as status quo, only because the perceived effort involved in changing them is overly difficult and full of friction?

With PayID will come the first foothold for a different kind of customer loyalty.

Should I stay or should I go?

‘Customer churn’ is rarely mentioned in financial marketing, despite their proximity to the telcos and utilities as a service. With this in mind, it feels like PayID is part of a wave of industry changes (including the forthcoming Open Banking reform) which will increase competition amongst brands. Churn will become possible as the friction points between brands are removed bit-by-bit for customers.

Chatting with Fusion's Digital Product Manager uncovers a perspective influenced by everyday contact with financial interactions:

“We expect the uptake of PayID to be akin to the shift from payment signature to PIN: early adopters are in-and-done from day 1. They'll be followed by a steady stream of those discovering it through their peers; with the unaware, laggards and tinfoil-hat brigade mingling at the back of the pack. That’s a typical bell-curve adoption rather than a deluge. Having said that, the predicted gold-rush to enlist customers to create their unique PayID alias with a particular banking institution may determine the future of smaller FIs.”

The move to PayID will open up the competitive landscape for Australian banks, fintechs and money platforms. Smarter financial institutions will be acting on this, refining their user experience, testing the onboarding journey and honing their product benefits.

New banking brands without physical footprints in Australia like Xinja and UP will be tackling life with PayID head on. They'll be quickly uncovering how a person’s relationship with their money will change with the new National Payments Platform (NPP) overlay services. They know that a memorable way to move money is an enabler for customers. After all, think of the spectrum of services and interactions a mobile phone number has unlocked for people.

Here’s where we see opportunity.

Look beyond the excitement of launch day to that swathe of customers who’ve setup a PayID and are getting back to their everyday transactions, albeit banking a little quicker than before.

Now consider that you’re a financial brand with a good product offering, an enjoyable mobile experience and have worked hard to make switching to you an effortless process.

Then pitch to prospectives that they can bring their PayID with them and take advantage of the great things you offer. Sound good?

“I will now bank elsewhere!” is the common cry by many exasperated Australians. Now that it's easier to pick up your money bags and move them, we may finally see this start to happen.

If you'd like to know how your brand can uncover the new opportunities provided by life with PayID,Let's schedule a time to chat.

We're proud to announce that Beyond Bank has won a prestigious CANSTAR Award for their mobile banking app, which has been created by Fusion.

"We are proud to announce Fusion as our Premium Partner of the Year for APAC region this year at Ascend," said James Norwood, Executive Vice President Strategy and CMO at Episerver.