5 Key Insights From the PauseFest Challenger Banks Panel

At the recent PauseFest conference in Melbourne, we were fortunate enough to attend a panel featuring some of Australia's leading challenger banks.

Dominic Pym from Up, Oliver Kidd from Archa and Simon Costello from Frankie Financial shared their insights on how they are running their organisations, and the state of the industry. Chaired by Alan Sim from Stone & Chalk Fintech Hub, the session was one of the highlights of the conference and provided great discussion and plenty of insights.

Here are the insights that caught our eye (and imagination!).

Focus on what your customers know they want, rather than amending a business model.

Oliver Kidd, Archa

Bigger organisations often try to amend a business model to fit customer needs, rather than serving those needs first. Bigger organisations are slaves to their business model - it's what all of their expenses and revenue are linked to after all. This makes it the central decision point when determining a new venture - how does this work with our business model. If it doesn't fit, it doesn't get funded, even if there is customer demand and need for the venture.

In contrast, challenger bank business models are developed alongside their offering for customers. This means that as customer needs change, the organisation's ability to scale and make money can change accordingly.

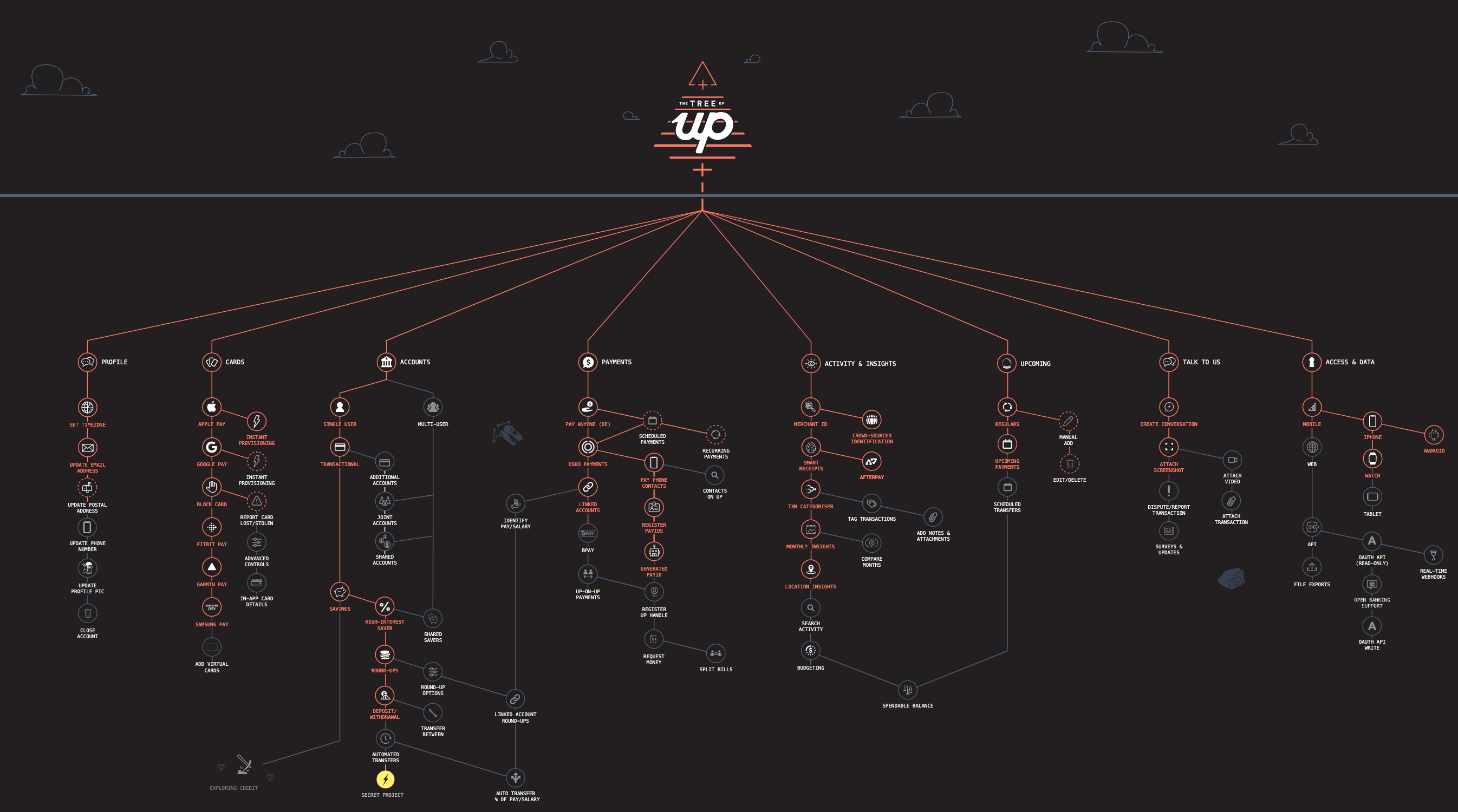

As Archa is still in early beta, they've built their platform using insights into their customers to dictate their direction and will continue to do so after launch. Up recently released their product roadmap and actively responds to user feature requests and suggestions. When was the last time a Big Four bank listened to you?

Up works on its product roadmap with its customers, to ensure that features in demand are developed first.

Challengers need to be 10x better for people to switch

Simon Costello, Frankie Financial

One of the key challenges for new organisations is finding a customer base. Even though the Australian public has seen the misbehaviour of the Big Four banks in the royal commission, there hasn't been a mass exodus of customers. Why? Inertia. They can't be bothered to go through the hassle of switching, and if they did consider switching, what makes your brand different?

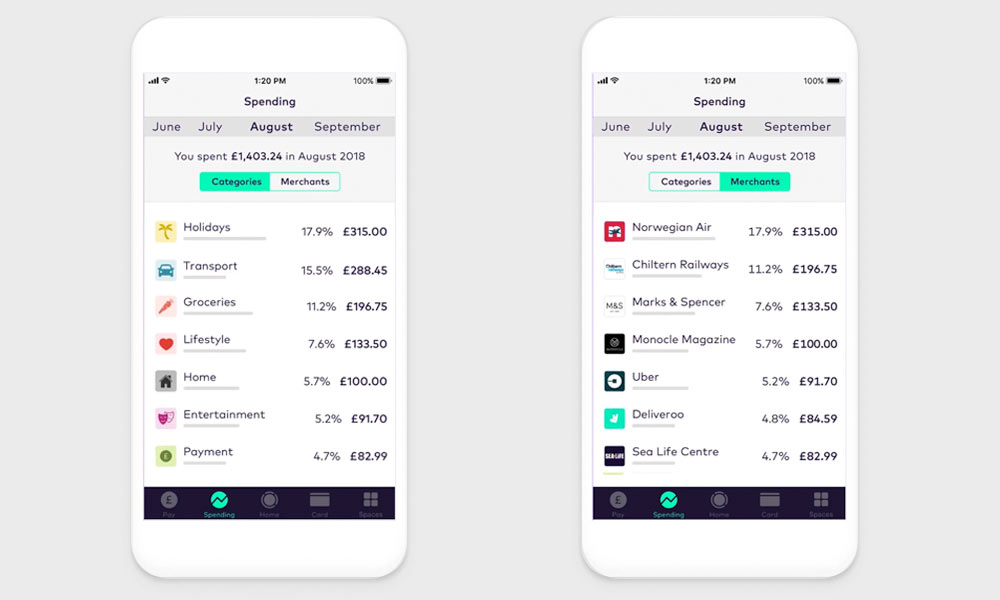

Challenger brands need to be 10x better than the organisations they're competing with to be competitive. Current challenger banks are doing this by making everyday banking flawless, and providing more insight into a customer's own money. They've also simplified the onboarding process, making becoming a customer a task that takes less than five minutes, with access almost instantly.

Atom Bank's onboarding process only takes a few minutes, and all on your phone.

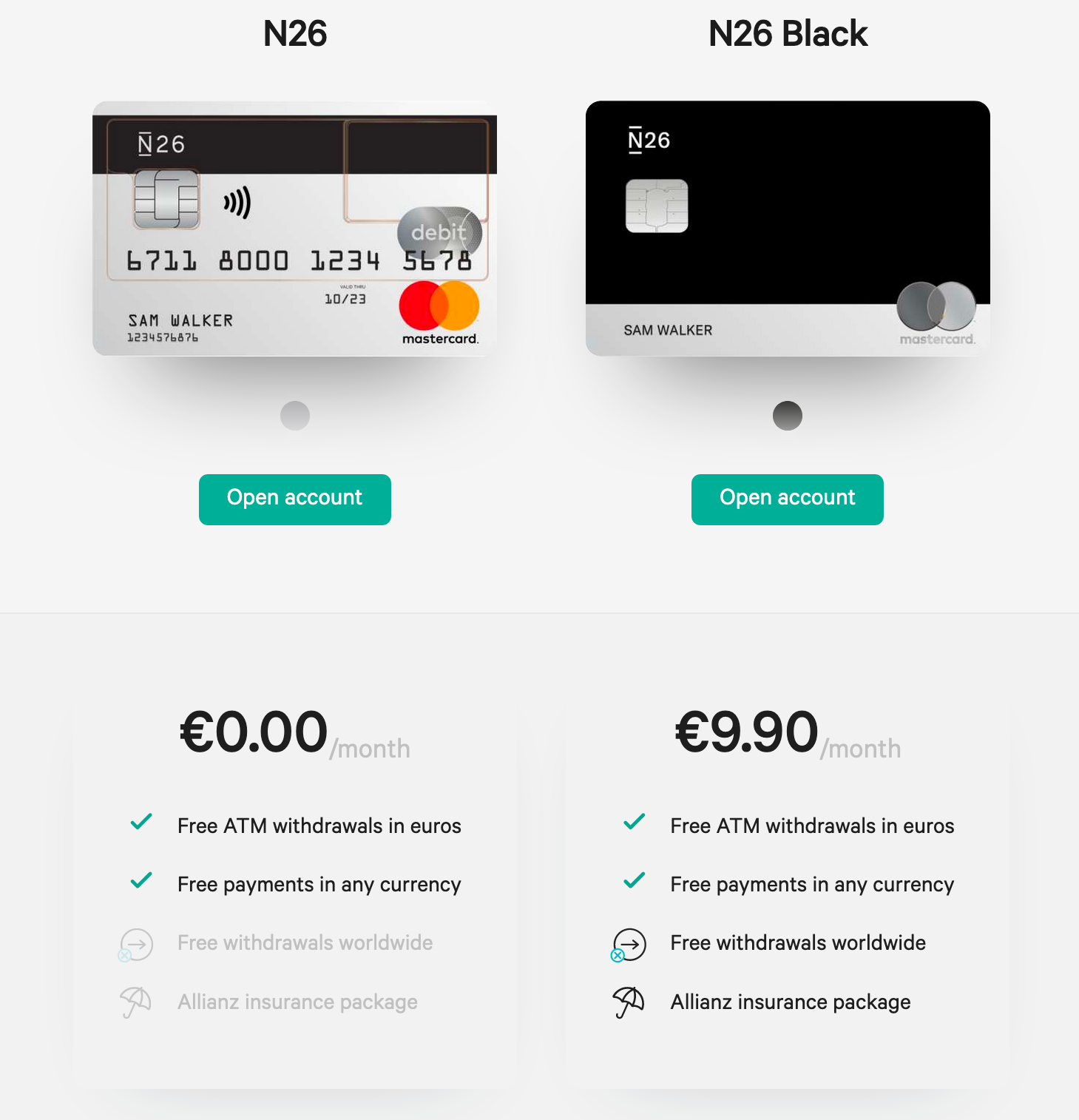

A fee is a subscription service you don't get anything for.

Oliver Kidd, Archa

Traditional financial organisations LOVE fees. $5 here, $5 there, knowing that it all adds up to a nice profit at the end. As Kidd points out, every subscription service basically charges you a fee to use their service. But in return, they give you the best service they possibly can. Big financial organisations charge fees to cover their own costs or their own inconvenience - there's nothing beneficial for customers here.

Challenger banks aren't looking to do this. At their core, they're looking to provide the best service they can to satisfy a customer need. If they can provide the best service that people will WANT to pay for, then they'll charge a subscription for it. More than just a nomenclature change, the subscription means that the customer is getting something for their money every month.

Customers can choose a plan for their debit card. The subscription service gives them more features than a standard version.

Lots of sexy & glamorous innovations are happening in the back end - not the front end.

Simon Costello, Frankie Financial

While customers only interact with a brand in the front end, most of the heavy lifting that makes the front end good to use is done by the back end.

The reality is that most of the innovations occurring with financial organisations are around the backend processes. Computing and hosting power rise every year, which allow costs to fall - over the last 4-5 years, costs of computing and hosting have halved. This allows challenger banks to compete with the computing and hosting requirements of standard organisations, and give them more time to focus on perfecting their brand and their offering.

Some of the biggest innovations for the banking sector will come from the back end of the industry. Aussie start up Look Who's Charging is helping both customers and the banks and is a back end service that is fuelling the clarity of transactions. Back end innovations such as these will allow organisations to pass these innovations through the front end to their customers.

While the front end looks smooth and crisp, all of the magic in Starling's merchant identification system is hidden in the back end.

Do we need to differentiate? No

Dominic Pym, Up

In the current environment, many of the challenger banks seem to offer the similar products, just with different brand colours.

Pym was quick to suggest that the challenger banks didn't need to differentiate, as they were perfectly happy learning and working together as they grow. Eventually, each brand will develop their own niche or product category that makes them money and they'll focus on, but differentiation wasn't a major part of the strategy.

By working together in this way, the banks are saving time - learnings and challenges are shared, with solutions all parties privy to them. We've seen similar successes with our Model Mobile partnerships with some of Australia's largest credit unions. By working together, we're able to grow as a unit with benefit going to all organisations and customers.

Fintech hub Stone & Chalk encourages collaboration and support as newer brands find their feet and enter the market.

The way forward

It seems the days of organisation-led, cumbersome and complex experiences with financial brands that are aggressively differentiating themselves feel numbered.

With Open Banking around the corner, we’re seeing the emergence of customer-centric, value-driven brands that work together to benefit customers. Technology underpins the experiences from these new players, with a great benefit to their level of customer service. The challenger banks are making it easy to drop in to their world to gain a sense of their offer with a completely different look and feel to a standard bank.

What’s most exciting to us is that rather than keeping customers at arm’s length, these brands are developing their products and services alongside their customers. Post-Royal Commission, that’s a breath of fresh air.

At Fusion we’re keeping an active eye on the challenger and neo-banks, and our regularly updated Neo-bank directory tracks the innovations, new entrants and star players from around the world.

Header image by @archa.