Fusion celebrates ISO 27001 certification

In exciting news, Fusion is now ISO 27001 :2022 certified for top-notch information security.

In exciting news, Fusion is now ISO 27001 :2022 certified for top-notch information security.

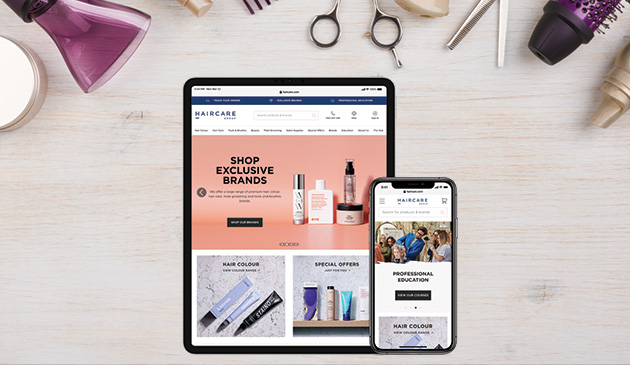

Market dynamics began to impact growth opportunities for Haircare Group, which meant a radical rethink of how customers could browse and buy professional salon products was required to continue business success.

We all know the feeling; you’re in a hurry, looking for something on a website - but you can’t find it. The search continues, Then, when you finally find what you’re looking for, it’s in a spot so illogical that it’s no wonder it was so difficult!

Greater Bank wanted to provide a personalised customer-centric digital experience for their website which delivered clarity, convenience and confidence as part of their 'customer-first' digital transformation strategy.

Working in the digital space might seem worlds away from conservation, but the more we chatted with Dr. Liberty Olds (Dr. Lib), about bird conservation and her work with the Orange Bellied Parrot, the more similarities began popping up.

We’re delighted to announce that Fusion is partnering with Zoos SA as exhibit sponsor of the Orange-bellied Parrot. We're excited to see where we can make a positive difference (however small it might be) to the planet and the species we share it with.

Fusion was selected to cross the ditch and deliver our Mobile Banking App platform to a consortium of 8 credit unions led by CU Baywide, the largest credit union in New Zealand.

Our Head of Strategy and Growth Mark Cox was joined by Gabriel Ponzanelli from Siteimprove and Deane Barker from Episerver in this insightful webinar about customer trust in digital experiences.

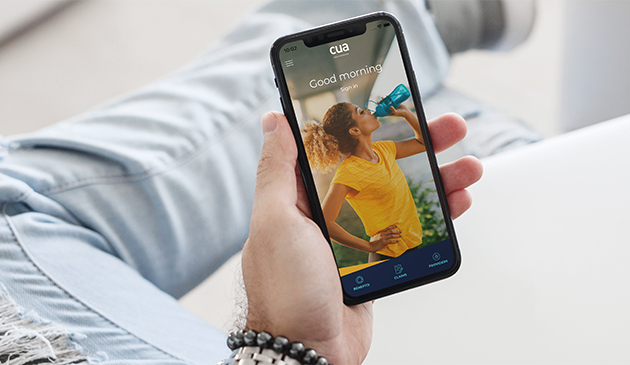

Seven leading health funds came together as a part of the Health Ally program to embark on a digital journey towards creating a health insurance mobile app platform unlike any other.

We’d like to wish a warm welcome to Volt Bank and Bank of Sydney who have recently joined Fusion’s financial services client community.

We’re proud to announce that Fusion has been awarded the Vertical Success Partner of the Year for Financial Services at the 2020 Epi Ascend (APAC) Conference.

There are large numbers of us experiencing this new way of working, there’s a good opportunity to learn from each other. At Fusion, we’ve come to the end of our first few weeks working from home and we want to share our learnings. They may help you with transitioning to the new working environment.

No matter the sector, the onboarding funnel is a crucial part of obtaining new customers. Ensuring this process is clear and efficient helps customers onboard easily while providing a good experience.

A primary conclusion from the research is there is a massive opportunity for health funds of all sizes to get ahead digitally, due to the fragmented nature and varied quality of mobile features on offer.

What we love about AR is its ability to include people in the experience. Unity is the major theme (and the name of) a new AR art piece by artist Richard Payne in conjunction with Melbourne based urban design firm Taylors, located on the front lawn of the Arts Centre Melbourne.

After six of our clients won Mozo Excellence Awards for their mobile banking apps, Mozo got in touch to chat about our opinion on the state of mobile banking and our predictions for the future.

At the recent PauseFest conference in Melbourne, we were fortunate enough to attend a panel featuring some of Australia's leading challenger banks. Here are the insights that caught our eye (and imagination!).

Fusion congratulates our client P&N Bank for their recent win in the AIM Pinnacle Awards. The Pinnacle awards recognise outstanding corporate, not-for-profit, community and government organisations in Western Australia.

In the Mozo Experts Choice Awards announced recently, six of Fusion/DA’s mobile banking App clients gained the accolade among the nine winners of the 'Excellent Banking App' award.

Australian tech company Atlassian is renowned for its unique and comprehensive framework for evaluating its internal teams. One of the reasons they work so well is because they celebrate outcomes - not outputs.

When we design new experiences, we look to automate any friction points and make the experience as smooth as possible. In the tech and design world, friction is a dirty word. But when can Friction be a good thing?

In a recent presentation at PauseFest, digital strategist Stephanie Winkler and senior strategist Hannah Murphy, both of Vice Australia, described how on the VICE website: 'content that highlights the ordinary, gets the clicks'.

In one of the best sessions at PauseFest 2019, Matt Whale and Lara Dolz presented their 15 pillar framework for generating a culture of innovation.

In his PauseFest presentation 'Don't underestimate the power of crazy', Stephen Yates - the Head of Design Transformation at Invision, outlined Imposter Syndrome and how it impacts us as individuals.

Fusion is hitting the ground running in 2019 by seeing some of the industries best speakers and minds present at PauseFest in Melbourne later this week. With speakers from Facebook, Amazon, Google and Atlassian presenting, it's sure to be an insightful couple of days.

A recent report published by digital agency Fusion and banking tech provider DA has concluded that despite having modest budgets compared to the Big Four banks, Australia’s credit unions and mutual banks are able to have the same depth of features in their mobile banking offering. The key to success? Collaboration.

When was the last time anyone in your organisation had time to put everything aside for a working week? We found the secret to conducting a five-day design sprint into just one.

In an environment where everyone wants the big knockout digital idea to flatten their competition, few consider the importance of short jabs or bursts of activity. Rather than overhauling your entire ecosystem, the smarter play is to make small changes quickly and regularly.

Football fans will do anything to avoid hearing the result of a game they want to watch later. This is how Optus let them down.

"We are proud to congratulate Fusion for the Digital Commerce Partner of the Year achievement" said James Norwood, Executive Vice President Strategy and CMO at Episerver.

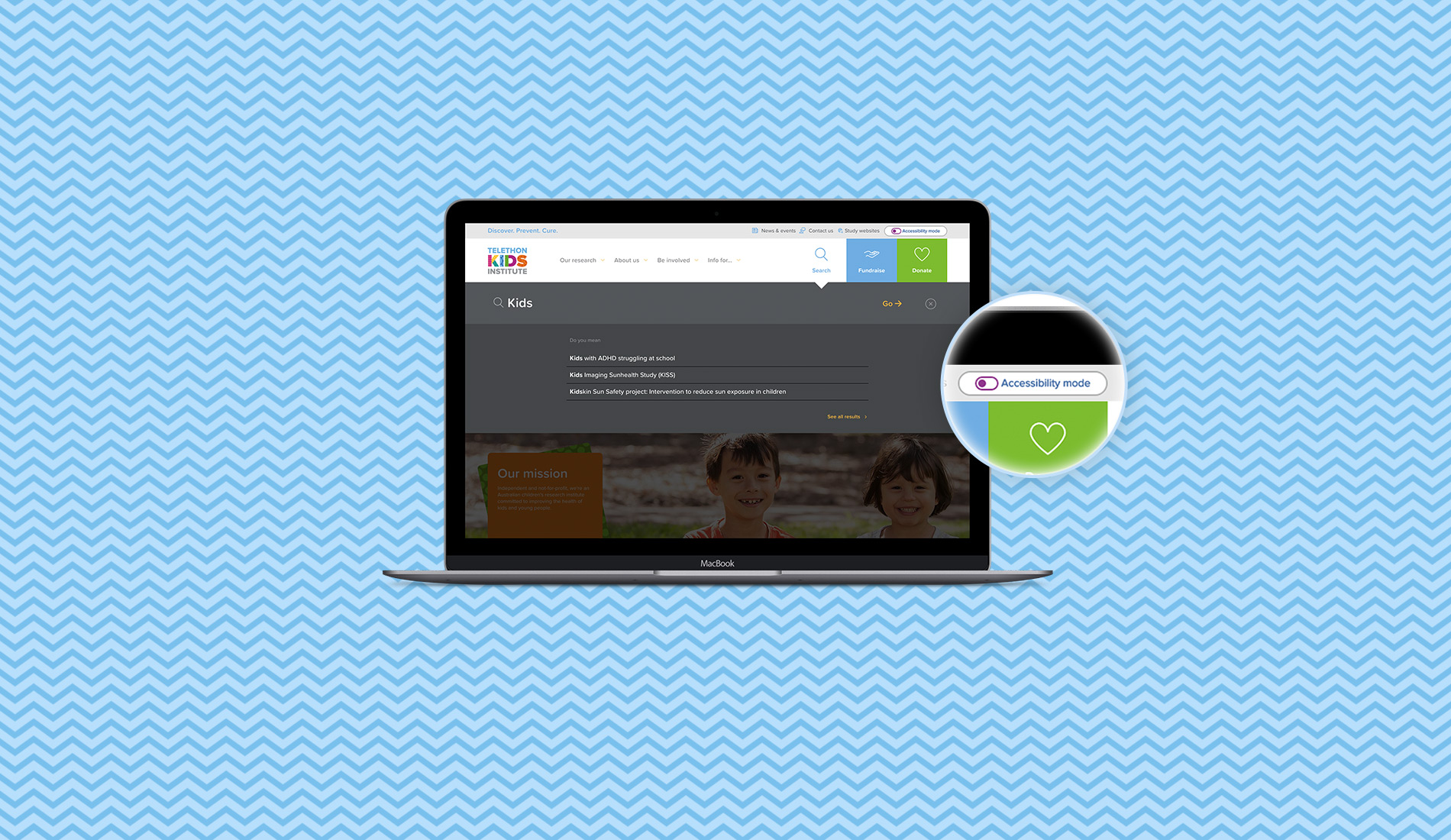

Designers often overlook the fact that some website visitors need high contrast colours to view content. One simple button is helping Telethon Kids demonstrate their commitment to providing accessible information.

For the average financial institution, customer loyalty remains the cornerstone of revenue. The Chief Retention Officer (CRO) sleeps soundly as long as human nature takes the short route to doing nothing. But the CRO may soon be having nightmares.

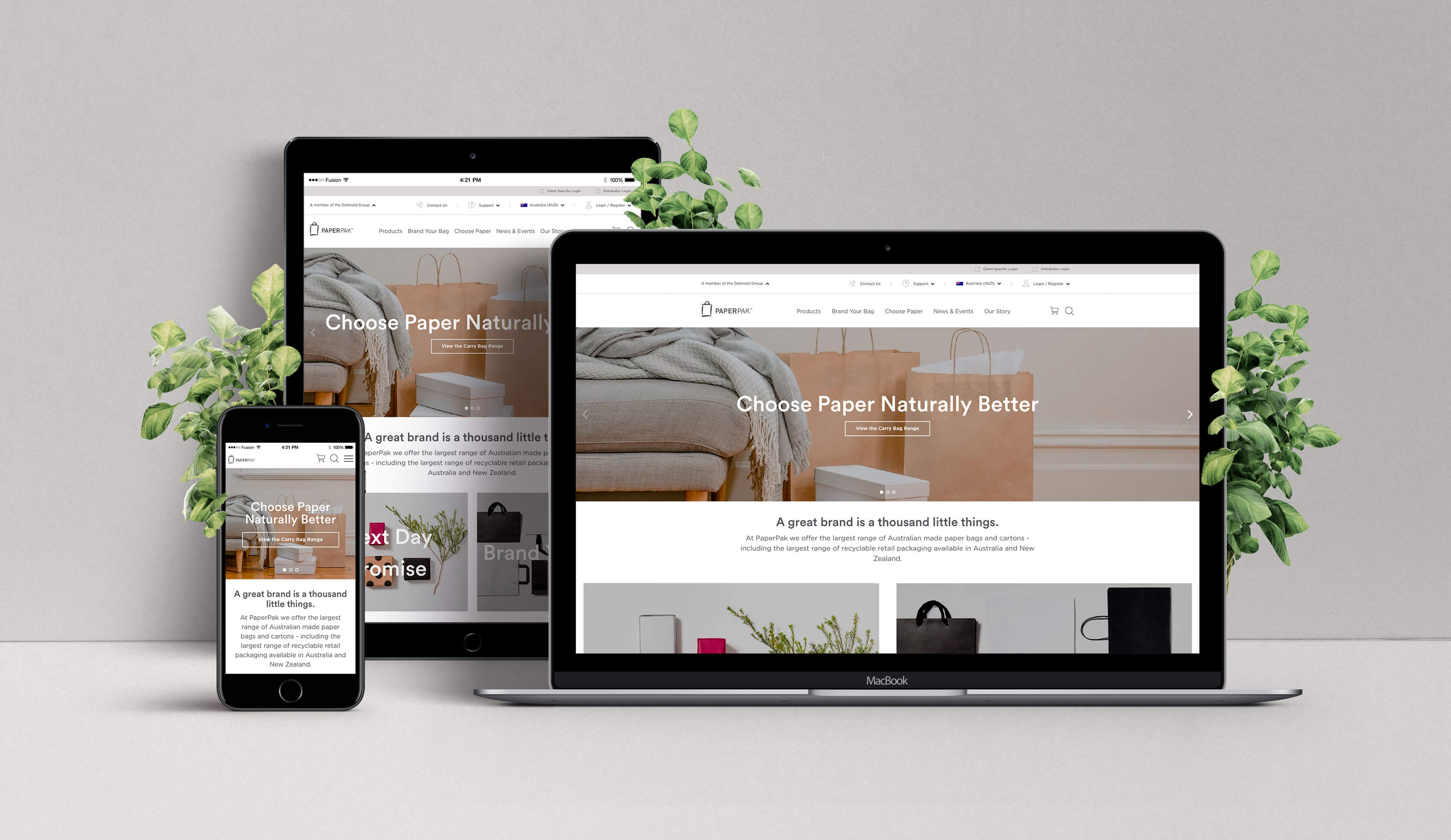

Fusion helped Paperpak, a provider of premium packaging solutions, create a simple and efficient commerce solution that elevates 'humble' paper products to 'hero level' status.

As a global company creating packaging for the food services industry, Detpak's customer base ranges from big brands like McDonald's and Subway to the owner/operator of your local laneway coffee shop. Regardless of size, they all search for food packaging that helps their brand shine.

As a Premium Episerver partner, Fusion is proud to see Episerver recognised as a Challenger brand in the Gartner Magic Quadrant for Digital Commerce, and as a Leader in the Forrester Wave for Web Content Management and Gartner Magic Quadrant for Web Content Management.

"We are proud to announce Fusion as our Premium Partner of the Year for APAC region this year at Ascend," said James Norwood, Executive Vice President Strategy and CMO at Episerver.

Fusion, today announced it has been certified as a Premium Partner of Episerver™, a leading provider of digital marketing and digital commerce solutions.

After a nation-wide pitch, Fusion was appointed by APA Group to revitalise their digital presence.

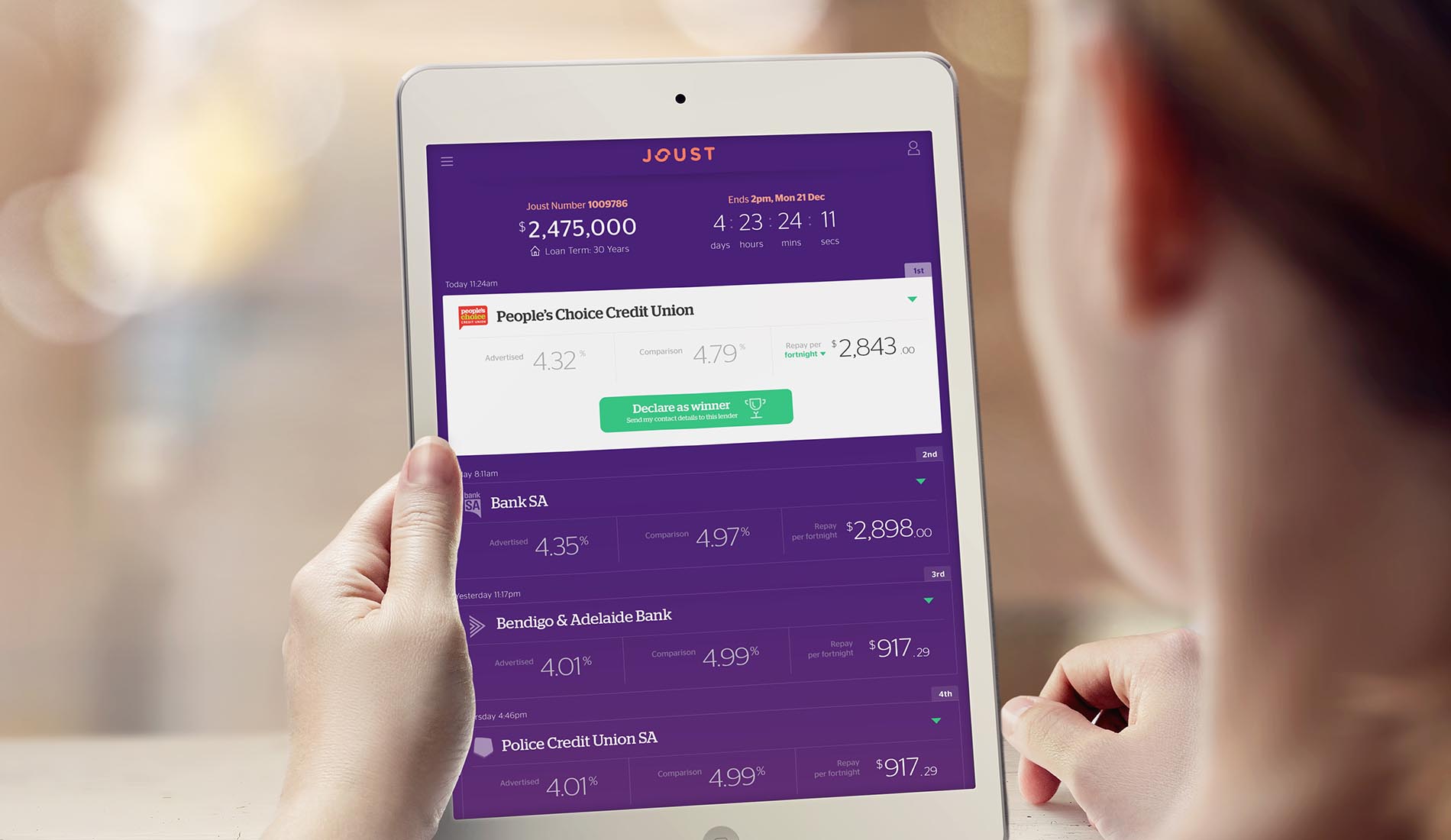

We worked on an intense program of SEO work which resulted in the Joust website being the top listing for the keyword ‘joust’ on Google within 6 weeks.

Fusion have partnered with the Motor Accident Commission to bring a virtual reality experience to the Tour Down Under 2016.

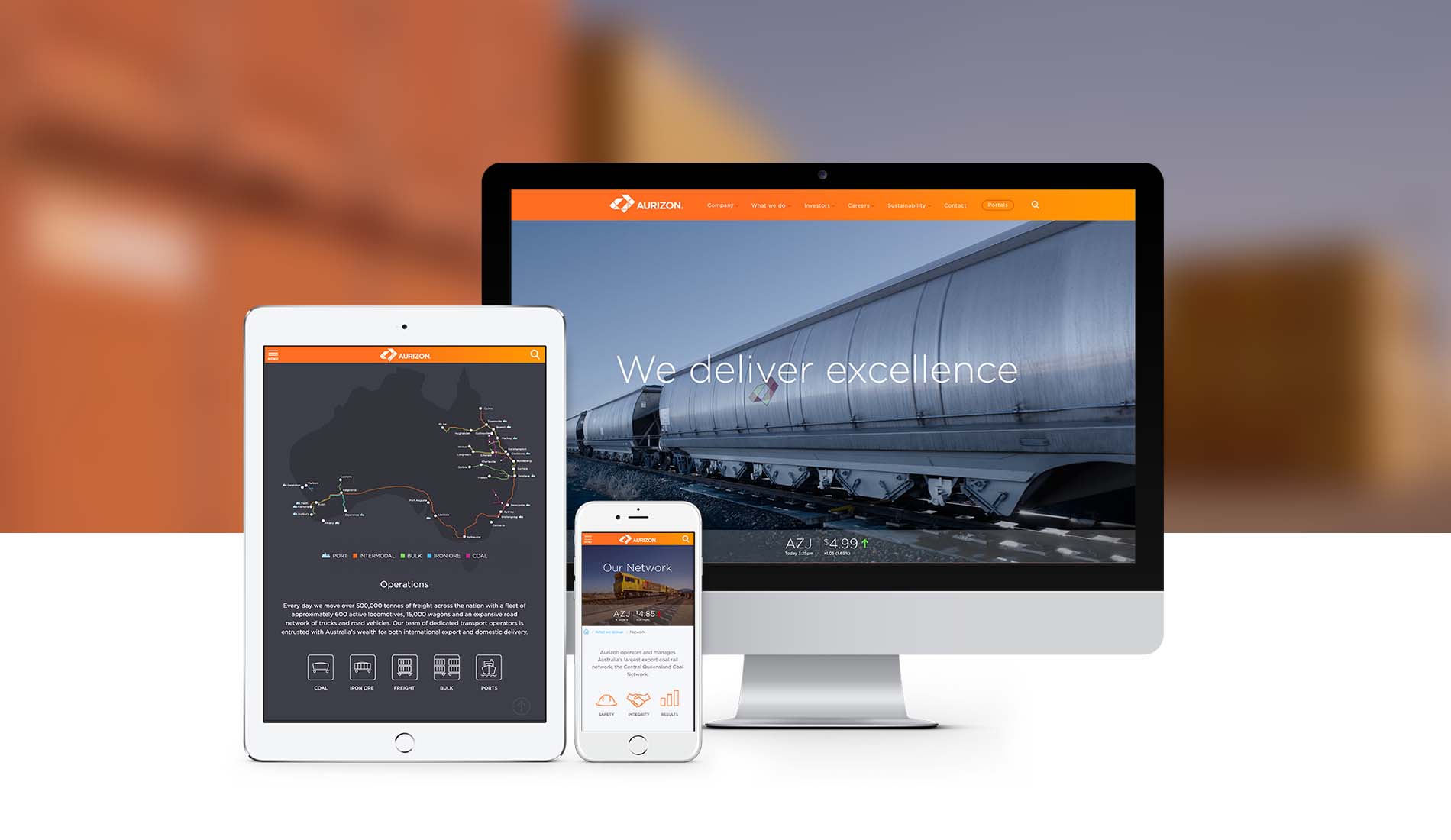

After a nation-wide pitch, Fusion was appointed by Aurizon as their digital strategy and implementation partner.

Love bringing up a fast, easy to use website on your smartphone the first time you search? Google does.

When visiting France you don’t want to stick to Paris.

A swimming pool?! In the Austrian Alps!? In WINTER!? Yes, you read that right!

Pack your thermals, warm up your cycling legs, and explore winter in the Jordaan area in Amsterdam.

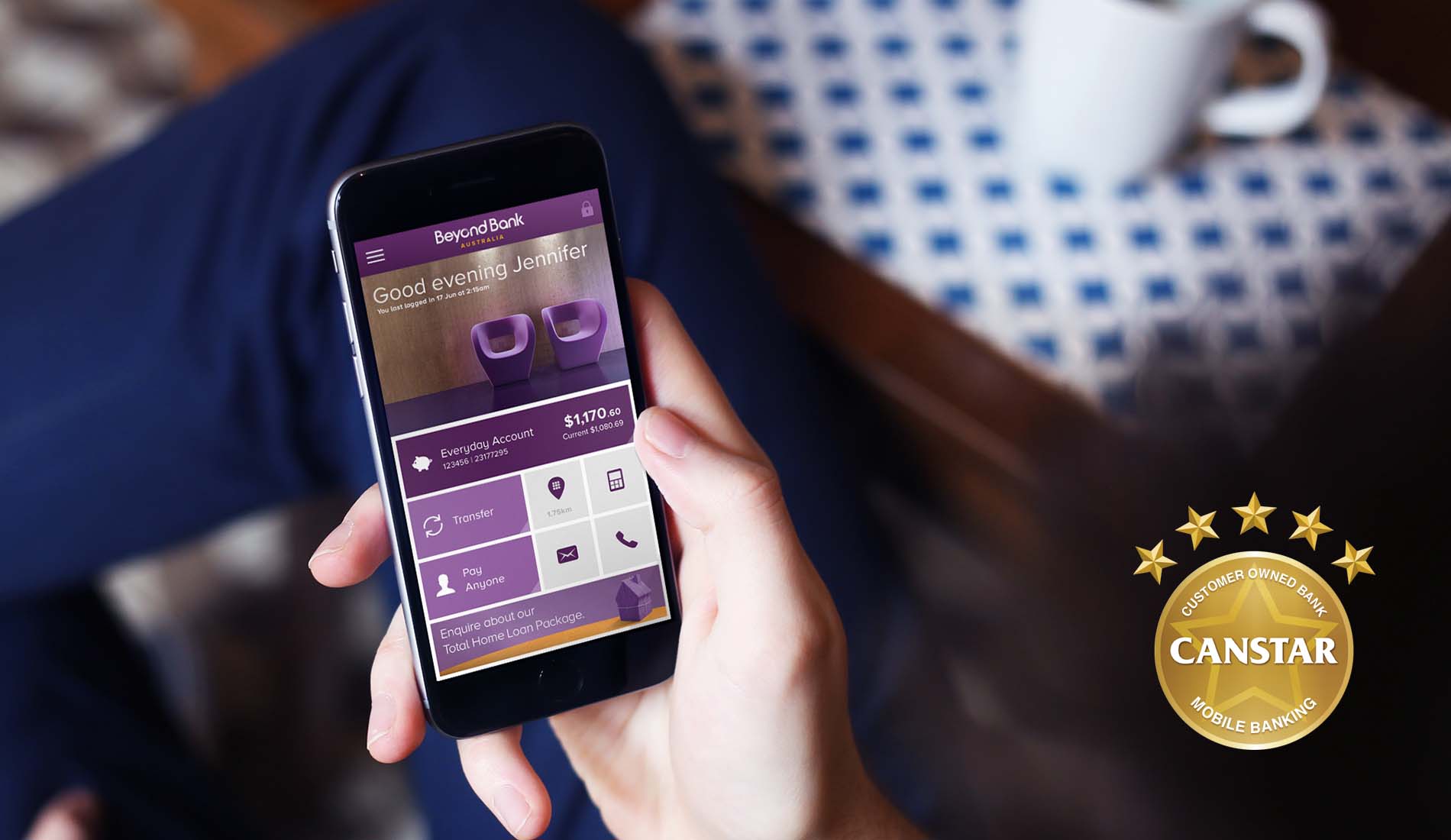

We're proud to announce that Beyond Bank has won a prestigious CANSTAR Award for their mobile banking app, which has been created by Fusion.

It’s not every day you get to brand a new Australian university. We have been privileged to be involved with Torrens University Australia, the first new university to open in Australia for more than 20 years.

Matsushima is known as one of the three quintessential views of Japan, famed for leaving the 16th Century poet Matsuo Basho lost for words with its beauty.

What better way to get to the majestic Grand Canyon than by helicopter.

It may sound strange to suggest Italian food in a Balinese town, but they must have a little Italian lady in the kitchen cooking up a storm because it’s the best Italian food I’ve ever tasted.

I’ve travelled all over the world but the place I found most stunning is a spot in Thailand called Phra Nang Beach.

The Magnificent Mile in Chicago is a must for those on a time budget.

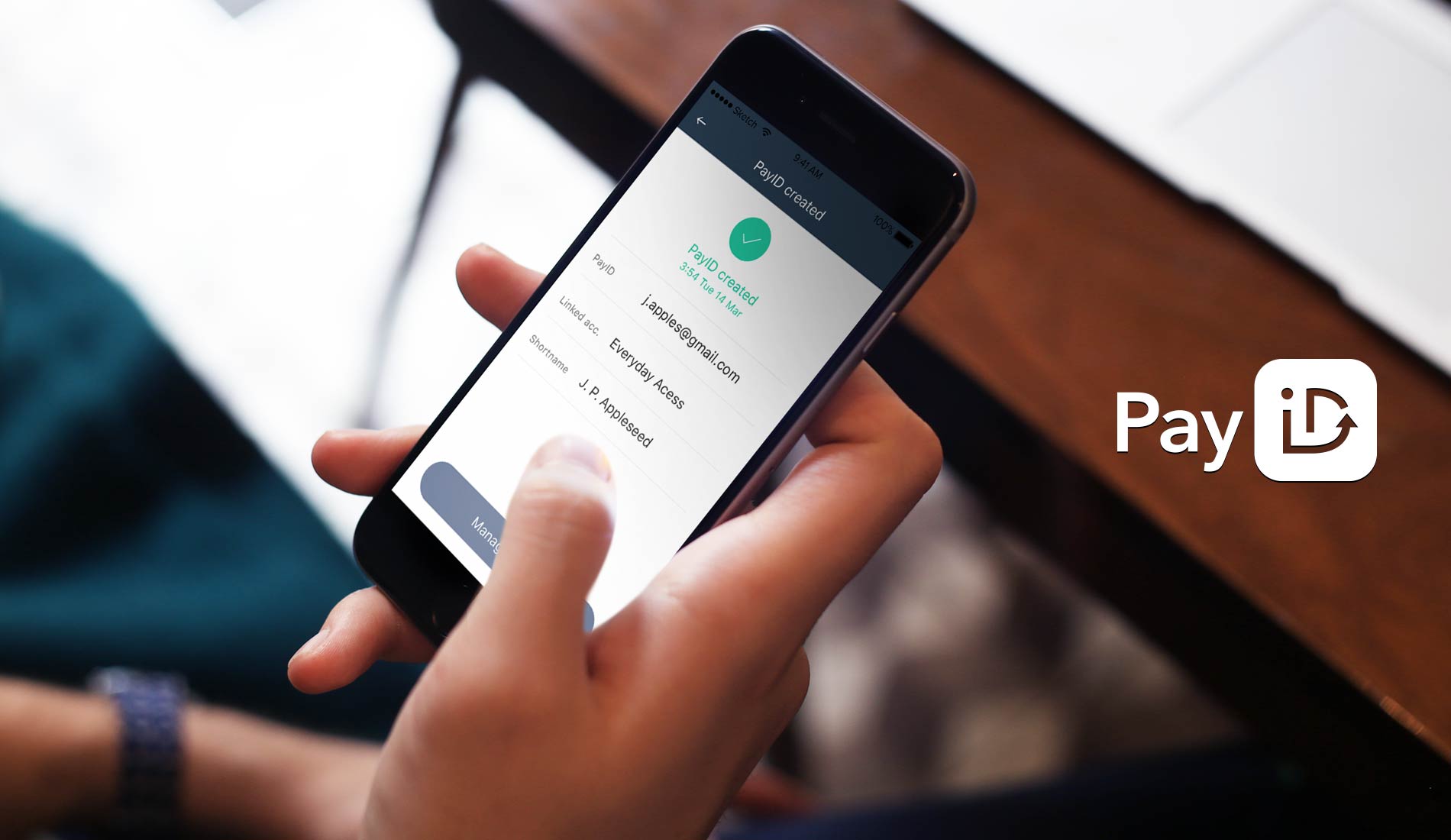

Launching a brand new type of bank account with all the contemporary necessities (Paywave, no monthly fees, eStatements, and internet banking, to mention a few) provides the opportunity to shake things up.

As Facebook is such a staple of people’s lives, MAC wants to use this platform to reach as many road users as possible. To help build their social media following, we created the MAC Game-Changer Facebook competition.

PINwise was an initiative of the Australian payments card industry to encourage the use of PIN instead of signature.

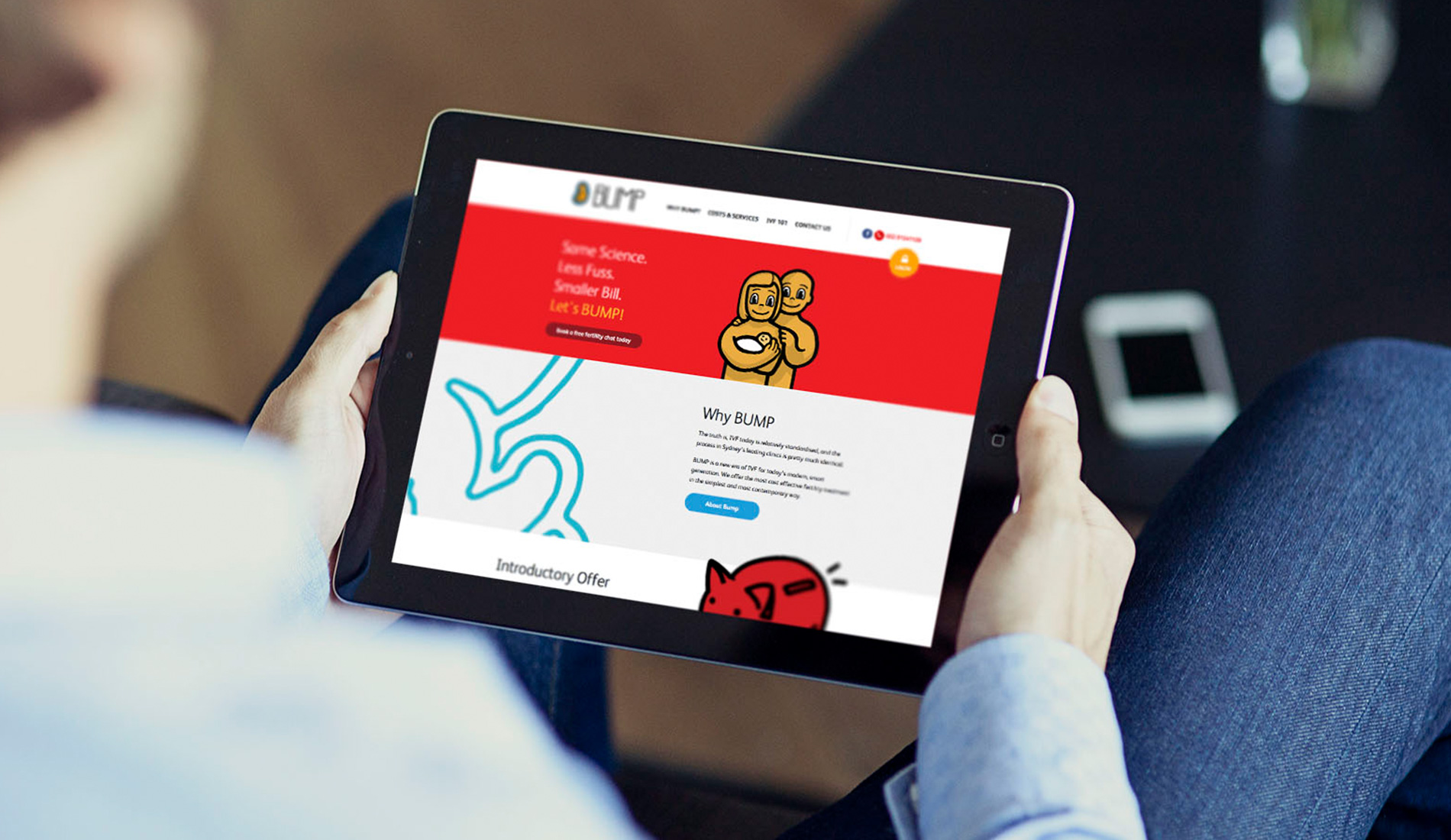

Bringing a more empathetic and cost-effective solution to IVF treatments was the driving message behind BUMP’s reimagined website. BUMP promises effective and contemporary fertility treatment in the simplest way. We were hired to put them in the position of digital pioneers in IVF solutions, with a better user experience and simple, clear content.

The Motor Accident Commission (MAC) is responsible for providing compulsory third party insurance and delivering public road safety initiatives in South Australia. One of the key ways to share these important messages effectively was by redeveloping their website into a modern publishing platform.

Bruges is known to be like a fairytale, so if you’re looking for something a little more whimsical when travelling, this is the European city for you.

Think about everything you could ever want from a lazy summer lunch in Italy.

If you go to the Cinque Terra villages, you have to do the walk from Manarolo to Cortona.

If you’re looking for some fairytale snow adventure, then Hakuba Valley with its eleven ski resorts and awesome snowfall track record is where you’ll want to be.

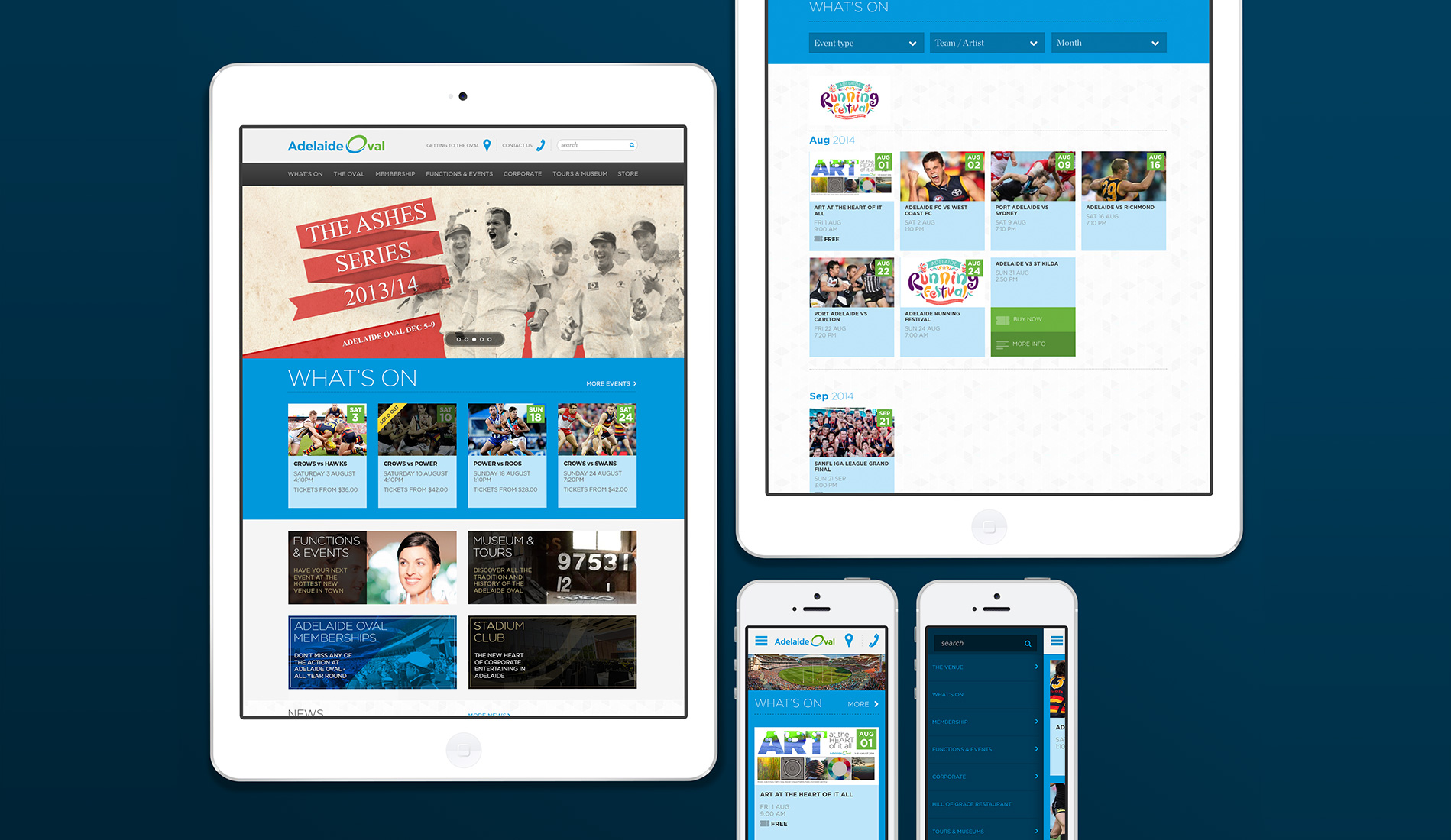

Sporting ovals are much more than circles of manicured lawn. Ovals fill with emotions, expectations, and shared success. The redevelopment of Adelaide Oval required a website befitting the new facility, reflecting the technological advancements and interpreting the new Adelaide Oval brand.

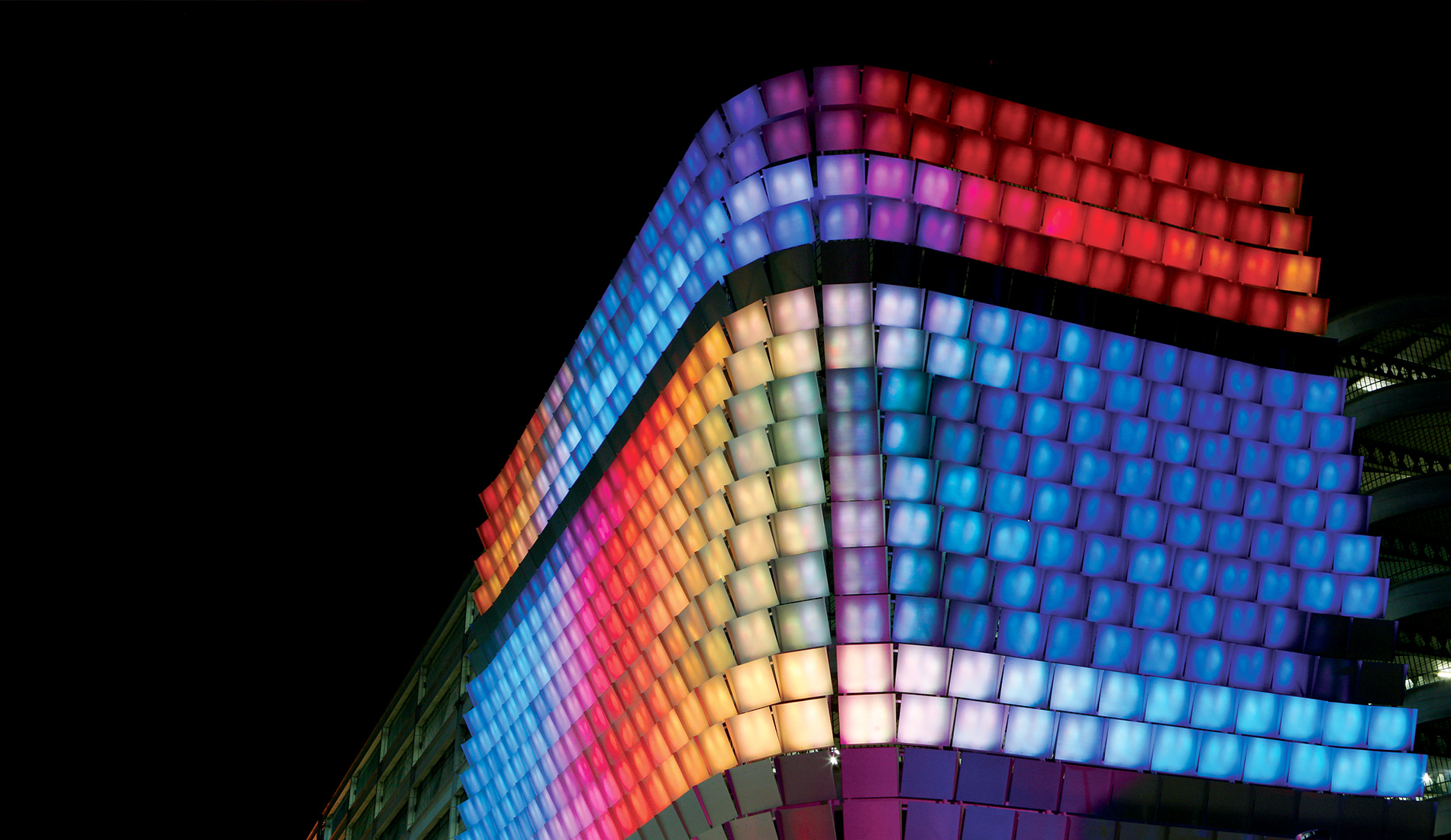

As designers of the Adelaide City Council Rundle Lantern it is rewarding to see the landmark evolve. In collaboration with the Adelaide City Council we have created Tweet the Lantern, built from an idea within the Rundle Lantern Strategy. A website and web service enable you to tweet specific hashtags that trigger displays on the Rundle Lantern’s 748 panels, enabling real-time public interaction.

The challenge of managing content for your responsive website is now a step easier. Fusion has become an official EPiServer Content Management System Solution Partner.

Providing medical indemnity insurance to doctors, midwives, and medical students, MIGA wanted to bring to life a new addition to their brand, Bluey. They needed a useful app that works to demonstrate their tagline ‘Always on your side.”

Making a house a home is all about how you live in it. With extensive guidelines outlining the key elements that make homes comfortable, safer and easier to use, Livable Housing Australia came to us with the need to make this key information available via mobile.

Incontinence is something most people don’t want to talk about. Going online offers pleasing anonymity, so ensuring incontinence sufferers can access free samples and gain product information is a priority when you’re Kimberly- Clark.

Big things in Australia tend to take on a cult following. Whether it’s fruit, crustaceans or fish, a surprise in scale can amuse and delight us. To raise public awareness of cycling safety as well as give the Motor Accident Commission a memorable presence at the Tour Down Under Village in Adelaide’s Victoria Square, we created a 40 metre high inflatable fluro green bike.

Tablet technology is changing the way we learn, work, relax and play. As an innovative global building infrastructure and consulting firm, Arup saw an opportunity to adopt new tablet technology within their inspection and auditing services.

When was the last time you took a drive in a car without a destination in mind?

Travel is cool and all, but what if you want to have an adventure without worrying about traveler’s cheques or insulting people with your poor grasp of their language and customs?

If you’re after beaches to die for, you can’t miss St Paul’s Bay in Lindos.

If you’re more Camden than Kensington and more Rolling Stones than The Beatles, take a peek at Leake Street graffiti tunnel.

STW, Australasia’s leading marketing content and communications services group, announced today a further step in its digital leadership strategy via a minority stake in Adelaide-based digital powerhouse, Fusion.

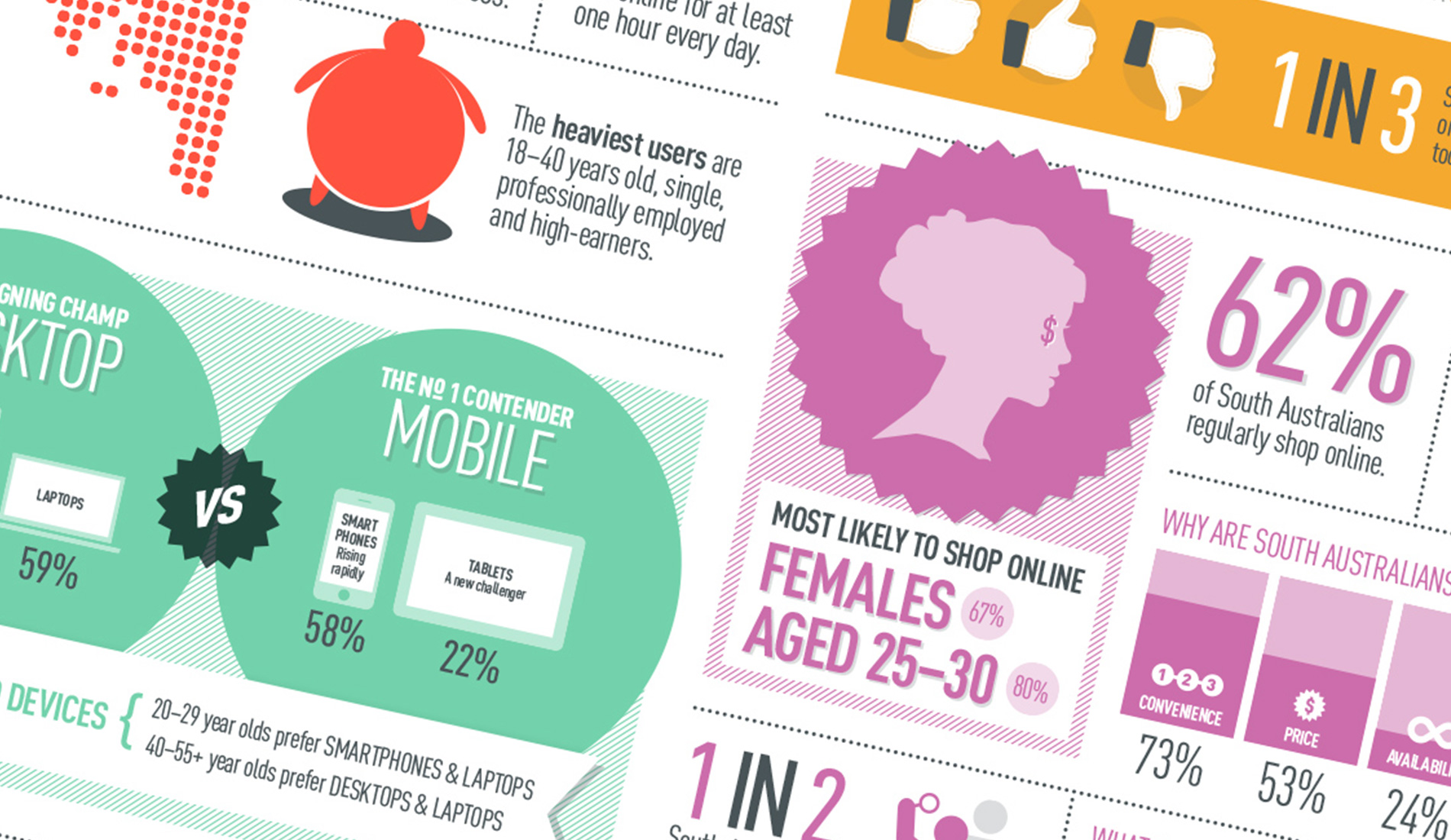

To help our clients make the most of the opportunities the internet provides, we wanted to know what South Australians are up to on the internet.

People often return to work from the New Year break without getting to fully experience every piece of their ideal holiday. This year we are trying to remedy this with our Fusion Build-a-Break gifts.

Global design and engineering practice, Arup is working with South Australian digital innovation agency Fusion “to revolutionise engineering” with an iPad app for project management.

Having the opportunity to drive a Ferrari is one thing, but being able to smash it flat out around one of the most famous race tracks in the world is another.

If you’re going to Japan, you need to visit the city of Kyoto!

Ever since I was a young lad growing up in the middle of England, my inner Robinson Crusoe longed for an exotic escapade.

The Our Nation App generates scenarios based on Australia's economic and demographic trend data.

Check out the Clipsal500 'Rock up to the race for free' TVC we created for the folks at the Motor Accident Commission to promote the free transport service that MAC and others provide to deliver a safe travel option for ticket-holders for the duration of the event. To further promote the service, we also designed and produced posters that have been installed inside metro buses, trains and trams for the weeks coming up to the event.

Despite having nearly a billion people actively using Facebook, their user interface has some problems. Facebook is meant to be helping us connect and find our friends, but its search function is actually hindering this fundamental process.

Having the opportunity to drive a Ferrari is one thing, but being able to smash it flat out around one of the most famous race tracks in the world is another.

As a parent of pre-tween kids, when looking to escape for a week or so I need to find something compelling for them, as well as a place that gives my wife and I an escape from the kids too.

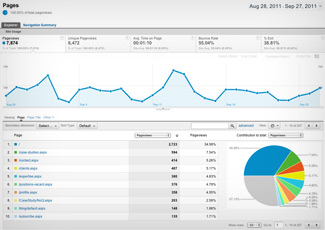

Back in the earlier days of websites and how we analysed them, you would be beating your chest about how many visitors your site was getting versus your mates - "ours gets 1,000 visitors per day, it's doing great guns", "oh but our site gets 10,000 a day so I'm going to be a very rich man" and so on. But then your smarter mate comes in and says "our site gets 500 conversions a day and I bet my site is more successful than yours" - and I bet he's right...

If you want to get away from the hustle and bustle of daily life, the Overland Track Hike across Cradle Mountain-Lake St Clair National Park in the Central Highlands of Tasmania will take you away from it all for five days.

To provide more prominence to the South Australian Cricket Association’s flagship team, the West End Redbacks, we created a new website specifically for the team to communicate directly with their fan base.

After battling with an old site and CMS that just wasn’t performing, Pro AV Solutions approached us for help to define, design, develop and deploy a great new site that not only solved their CMS problem, but also gave them a seamless e-commerce system that increased their national online presence. They now have a new online store that displays their expansive product range, while also showcasing the expertise of their friendly staff.

To effectively catalogue and display their range, we designed an innovative online seed selector. Budding gardeners can now visit the virtual garden shed and enter a series of inputs that show the right seed and complementary products suitable for their backyard. The custom shopping list can then be printed for easy in-store purchase.

Medallion Homes are excited to announce the launch their refreshed brand identity and new website. Fusion lead a series of Brand Focus workshops where we worked very closely with the Medallion team to uncover many of the little known truths about the business behind the brand - known only by their customers.

The Yalumba Wine Company wanted to connect to hundreds of people who are geographically dispersed such as winemakers, vineyards crew and distributors. They needed an online communications platform to easily find and share information efficiently.

The Motor Accident Commission (MAC) sought new ways to better activate their sponsorship of Schoolies Festival. Leveraging the insight that young people value the opinions of their peers above all others, our strategy began by creating the positive message, ‘Look Out For Your Mates’. This created a platform that would resonate with peer conscious friends, inspiring them to keep each other safe.

Fusion enjoyed an evening of magic and success at the 34th Adelaide Advertising and Design Club (AADC) Awards as can be seen on video and Facebook. The very funny magician, Matt Hollywood, provided some early entertainment and crowd victimisation (sorry, participation) that we were fortunate enough to avoid. We saved our stage presence for later, collecting five Finalists and three Awards.

Naming rights sponsorship for the 2010 Santos Tour Down Under gave Santos a great opportunity to build brand awareness on a scale like never before. We noticed there was no online community for local or out-of town cyclists to connect, so we created a micro-site for riders to share training meet ups, cycling tips, follow STDU updates and of course meet for a well-earned drink afterwards!

Mobile apps promote brands around the world, so Fusion recently devised an app to globally reach prospective students who have Australia on their radar. We started by looking at what tourists love about Australia; koalas! We also knew that entertainment apps were popular, as were alarms.

The cream of the crop of the Australian design community came together on the 16th of October at the Brisbane Convention Centre for the presentation of the 10th AGDA National Biennial Awards. Some 2,000 plus entries were received for the Awards across 18 categories. In total there were 241 Finalists, 167 Distinctions and 8 entries achieving AGDA's highest accolade, the Pinnacle.

Increasing brand exposure and bottom line results, Dalrymple wanted to harness the power of the internet to meet the diverse needs of pinot-loving consumers and media – while not eclipsing the provenance of its rich, family owned heritage.

Increasing member participation was front of mind for National Pharmacies as they recently implemented a new range of member-focused features to their website.

Beautiful book design illuminates AARNet’s pioneering role in bringing the internet to Australia.AARNet approached Fusion to design and produce a stunning book to document their fascinating history.